how much taxes does illinois take out of paycheck

If youre married filing jointly youll see the 09 percent taken out of your paycheck if you earn 250000 or more. Our online Weekly tax calculator will automatically.

What Businesses Need To Know About Illinois New Budget The Good The Bad And The Ugly

Employers in Illinois are required to remove 145 percent from each employees paycheck as a state mandated deduction.

. Illinois Estate Tax. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. There is an Additional Medicare Tax of 09 percent withheld from employees paychecks if they earn more than 200000 annually regardless of their income tax filing status or wages earned at another job.

A married couple who earns 126000 per year will take home 9710312 after tax. What percentage is taken out of paycheck taxes. Pay FUTA unemployment taxes which is 6 of the first 7000 of each employees taxable income.

Regardless of your filing status the income tax is a flat rate of 495. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Illinois. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Illinois is one of 13 states with an estate tax.

This means you wont. You can even use historical tax years to figure out your total salary. After a few seconds you will be provided with a full breakdown of the tax you are paying.

ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible. Personal Income Tax in Illinois Personal income tax in Illinois is a flat 495 for 20221. The Illinois state income tax is a flat rate for all residents.

Select the Illinois city from the list of popular cities below to see its current sales tax rate. The Illinois salary calculator will show you how much income tax is taken out of each paycheck. The Illinois Paycheck Calculator uses Illinois tax tables and Federal Income Tax Rates for 2022.

Switch to hourly Salaried Employee. As of 2021 estates worth less than 4 million are exempt. This Illinois hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Illinois Hourly Paycheck Calculator. Illinois Resources Illinois calculators Illinois tax rates Illinois withholding forms More payroll resources. What taxes do Illinoisan pay.

Yes Illinois residents pay state income tax. Total income taxes paid. Amount taken out of an average biweekly paycheck.

Although you might be tempted to take an employees earnings and multiply by 495 to come to a withholding amount its not that easy. 8 New or Improved Tax Credits and Breaks for Your 2020 Return. The first step to calculating payroll in Illinois is applying the state tax rate to each employees earnings.

Employers are responsible for deducting a flat income tax rate of 495 for all employees. Salary Paycheck Calculator Illinois Paycheck Calculator Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. You can claim a tax credit of up to 54 for the state unemployment tax you pay.

2 days agoA provision tucked into the 19 trillion American Rescue Act COVID relief package passed in March 2021 eliminates federal taxation on forgiven student loan debt through 2025. Only you as the employer are responsible for paying. Overview of illinois taxes illinois has a flat income tax of 495 which means everyones income in.

You can then email the Illinois Paycheck Calculator to yourself or to a loved one to help you figure out your finances. The Illinois Salary Calculator also shows you how much you. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits.

Estates over that amount must file an Illinois estate tax return and face tax rates up to 16. Just enter the wages tax withholdings and other information required below and our tool will take care of the rest. Amount taken out of an average biweekly paycheck.

But not all estates that file a return will pay taxes. No cities within Illinois charge any additional municipal income taxes so its pretty simple to calculate this part of your employees withholding. A single Illinoisan who earns 63000 per year will take home 4855156 after tax.

Youll use your employees IL-W-4 to calculate how much to withhold from their paycheck. How much do you make after taxes in Illinois. To use our Illinois Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

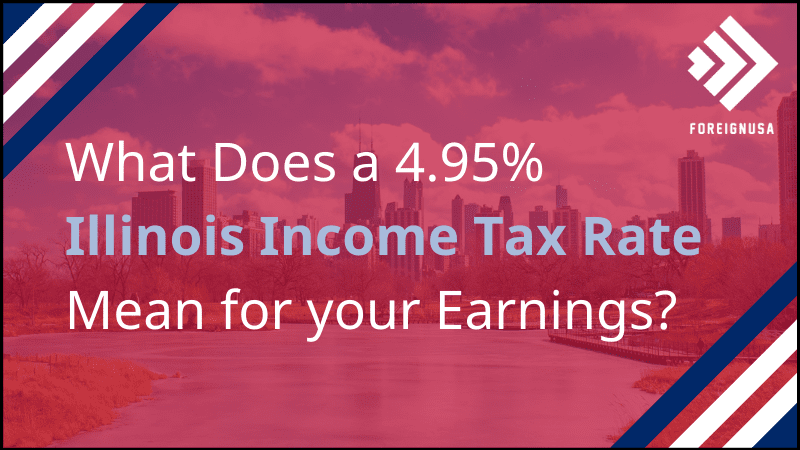

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Total income taxes paid. According to the Illinois Department of Revenue all incomes are created equal.

Illinois has recent rate changes Sun Jul 01 2018. Overview of Illinois Taxes Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state. Paid by the hour.

Sales Tax Is Called A Regressive Tax Because People Who Make Less Money End Up Spending A Larger Portion Of Their Pay Infographic Math Review Finance Investing

Here S How Much Money You Take Home From A 75 000 Salary

The Illinois Income Tax Rate Is 4 95 Learn How Much You Will Pay On Your Earnings

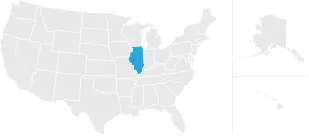

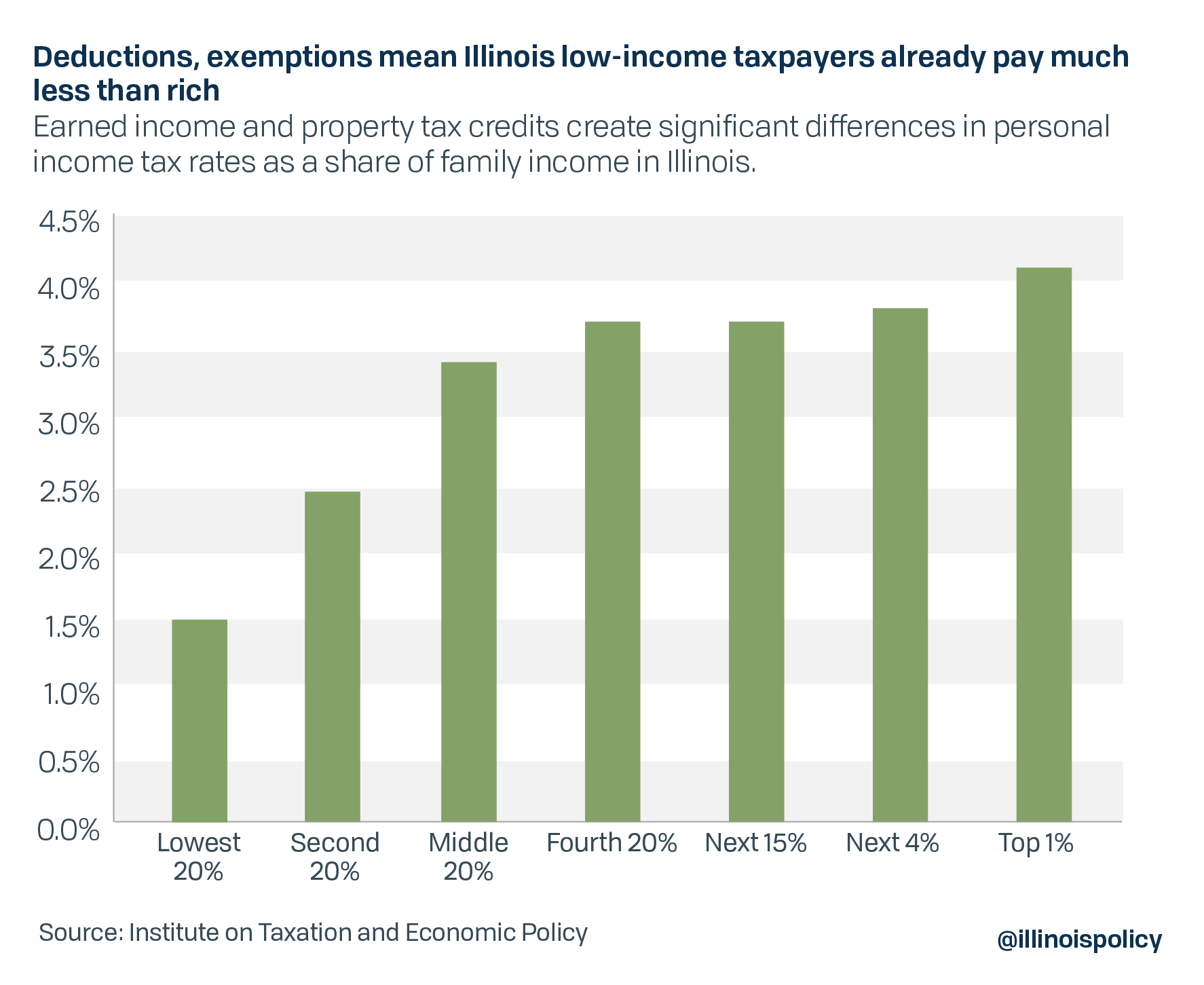

Exemptions And Deductions Give Low Income Illinoisans Less Than Half Tax Rate Of Rich

Exemptions And Deductions Give Low Income Illinoisans Less Than Half Tax Rate Of Rich

Where S My Illinois State Tax Refund Il Tax Brackets Taxact

Celebrating America Saves Week 7 Ways To Automate Your Savings Plan Well Retire Well How To Get Money Money Financial Financial Help

According To Tax Foundation California Ranks 49 In Migration Of Personal Incomes Illinois Map State Map

Texas Paycheck Calculator Smartasset Com Paycheck Calculator Nevada

Why Illinois Is In Trouble 122 258 Public Employees Earned 100 000 Costing Taxpayers 15 8 Billion Despite Pandemic

I Have A Monthly Wage Of 1 000 But Need To Pay Tax At 220 So I Just Have 780 In The End Is This Kind Of Tax Rate Common In Illinois Quora

Slew Of Bills Signed By Gov Pritzker Helps Propel Illinois Property Taxes To Nations Highest Wirepoints Wirepoints

Illinois Has The Highest Taxes Nationwide Report Finds Mystateline Com

Remember Illinois Has A Flat Illinois Working Together Facebook

A Complete Guide To Illinois Payroll Taxes

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)